We advise entrepreneurs in the legal planning (corporate and tax) and implementation of their business model in Peru and in their scaling process at a regional level. We advise investors and entrepreneurs in equity, SAFE or convertible debt financing rounds, in flip processes, shareholder agreements, vesting schemes, stock options, etc.

We advise entrepreneurs and regulated companies on the implementation of Fintech and Insurtech business models, including alternative financing (online lending, P2P marketplace, crowdfunding), factoring, foreign exchange, means of payment, remittances, e-money, credit scoring, robo-advisory investment, etc.

We assist corporations focused on innovation via alliances with or investment in startups, or internal incubation of projects. We also advise them in their digital transformation processes, including electronic contracting mechanisms, adoption of electronic signatures and personal data protection policies.

We advise issuers, structurers, placement agents and investors in the structuring of capital market transactions, including the issuance of debt instruments through public and private offerings.

We advise borrowers, structurers, trustees, security dealers, financiers and investors on the structuring of financing transactions, including corporate financings and project financings.

We advise investment fund managers, trustees, securitization companies and investors on the structuring of stand-alone assets, such as investment funds, bank trusts and securitization trusts.

We advise banks and other financial entities, insurance companies and private pension managers on the regulatory framework for their ordinary operations, regulatory compliance, investment regulation and licensing processes.

We advise securities market entities, including broker-dealers, fund managers and securitization companies, on the regulatory framework for their ordinary operations, regulatory compliance and licensing processes.

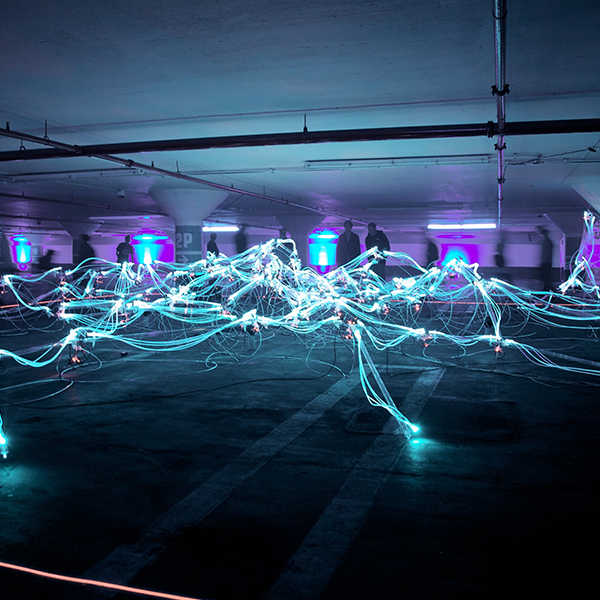

Advice to entrepreneurs of business models based on blockchain technology and crypto economics (exchanges, wallets, investment platforms), in order to reduce legal contingencies in a scenario of lack of express regulation.